"I have no hesitation in recommending Moneyplex for anyone needing a brokerage service".

Simon MWollongong, New South Wales

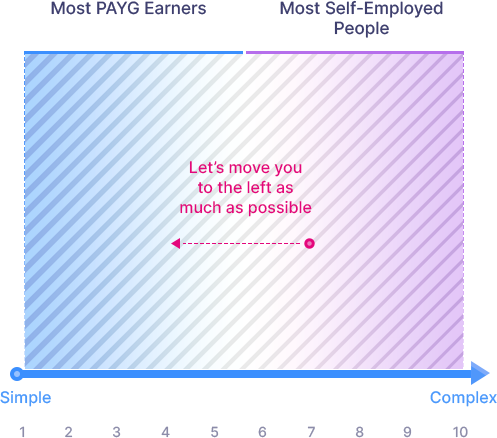

We use our detailed knowledge of self-employed bank policy to get your lending approved with the optimal mix of rates, flexibility and policy for your circumstances.

Please be assured this will not be a thinly disguised sales presentation. Instead, you will receive personalised information relevant to your specific situation.

Naturally, you can try to implement ideas yourself. Or, like our hundreds of happy clients, you can relax and let us do it for you. In any case, we look forward to meeting you for your no-obligation, Lending Strategy Session.

People Are Talking About MoneyPlex

The MoneyPlex team are extremely experienced in helping homeowners, investors, and business owners secure their property and asset finance. Here’s what some of our recent borrowers say about their experience with MoneyPlex

"I have no hesitation in recommending Moneyplex for anyone needing a brokerage service".

Simon M

"Peter and Glenn, from Moneyplex, go the extra mile to ensure a terrific result, particularly in difficult loan situations. I can highly recommend them to anyone seeking property or development finance.".

Craig M

"I would absolutely recommend MoneyPlex for your mortgage needs and will certainly be using them again.".

Simon M

"All in all a professional and personal service that removed stress and ensured we got the best possible outcome.".

James SRequest Your Lending Strategy Session